Policy statement on Hybrid Mismatches updated; no longer double taxation in cost-plus situations | Meijburg & Co Tax & Legal

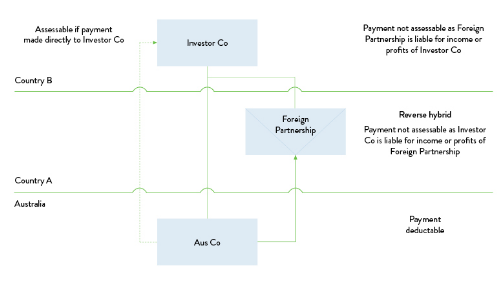

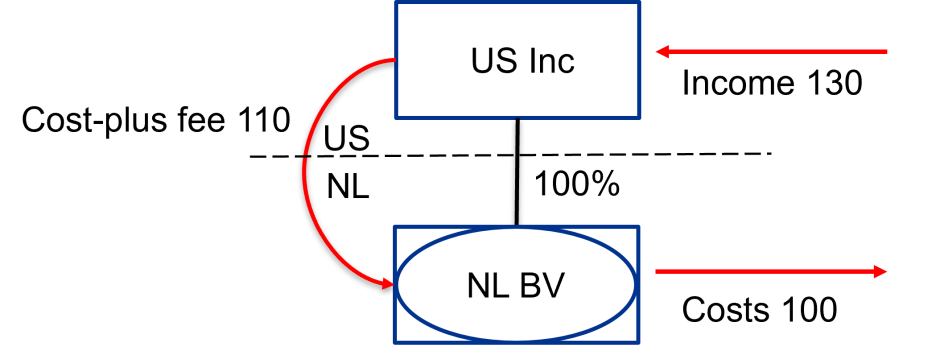

Revised draft hybrid mismatch rules – potential impacts for real estate and infrastructure investments

Revised draft hybrid mismatch rules – potential impacts for real estate and infrastructure investments